If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company . Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers. An Exclusive Provider Organization is designed for integration of a healthcare plan, health providers and an insurance company. An EPO plan manages cost by improving quality and health of members by using select providers . An EPO plan promotes quality through transparency initiatives and policies that promote member health and manage the care members receive. An EPO plan often covers services in-network with network providers and has $0 benefits for out-of-network.

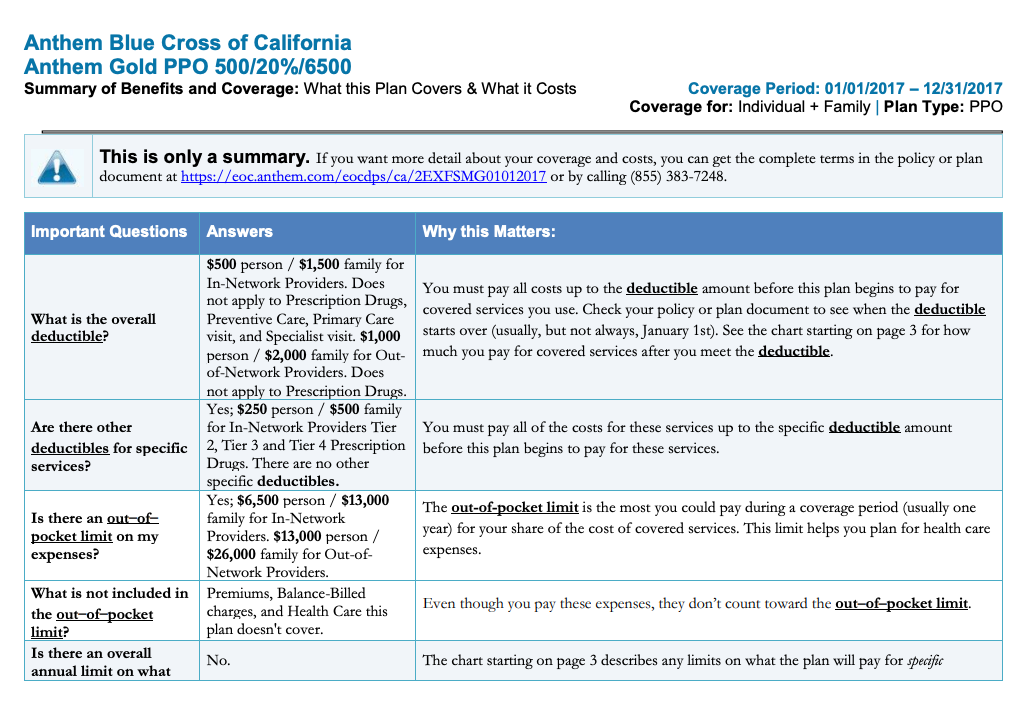

This plan combines traditional medical coverage with a Health Savings Account . Under this plan, all covered services (except preventive services/prescriptions) are subject to the annual deductible. The deductible is a dollar amount of out-of-pocket costs you must pay each year before the plan will begin paying its share of your healthcare expenses. The nice thing about this plan is that you can pay for that deductible using the tax-free funds in your HSA. Once the deductible has been met, most in-network services are covered with a 20% coinsurance.

Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine. Some health insurance plans do not have co-pays, but many do. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network. You might see another list with 2 different percent amounts.

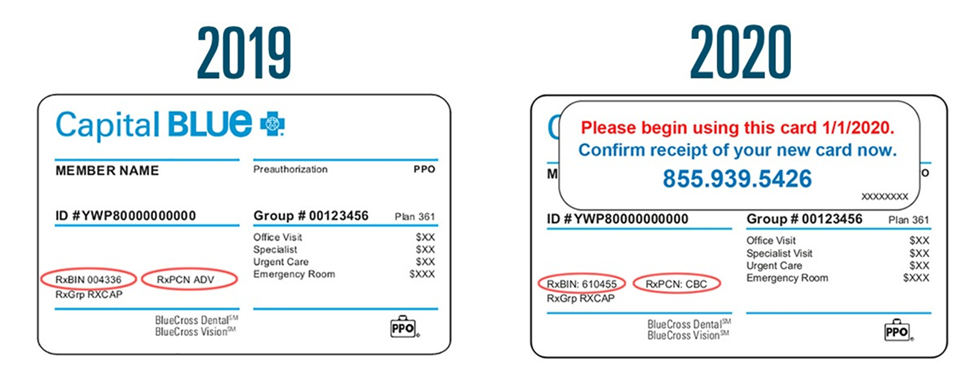

EPO -- stands for Exclusive Provider Organization -- is similar to an in that it is a healthcare plan that covers eligible services from providers and facilities inside a network. Generally, an EPO does not pay for any services from out-of-network providers and facilities except in emergency or urgent care situations, which is similar to an HMO. Unlike an HMO, EPO participants are not usually required to have a primary care physician or referrals. Your health insurance company might pay for some or all the cost of prescription medicines. If so, you might see an Rx symbol on your health insurance card.

But not all cards have this symbol, even if your health insurance pays for prescriptions. Sometimes, the Rx symbol has dollar or percent amounts next to it, showing what you or your insurance company will pay for prescriptions. Telehealth benefits available to all plans either from Blue Cross NC or through the provider network. Blue Cross NC provides the telehealth program for your convenience and is not liable in any way for the goods or services received. Blue Cross NC reserves the right to discontinue or change the program at any time without prior notice. Decisions regarding your care should be made with the advice of a doctor.

Depending on your plan, selected programs may not be available to you at this time. Check with Blue Cross NC Customer Service to determine your eligibility. Blue Cross NC has contracted with a third-party vendor independent from Blue Cross NC to bring you telehealth benefits. The "coverage amount" tells you how much of your treatment costs the insurance company will pay.

This information might be on the front of your insurance card. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent. You might see several percent amounts listed together. For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care. The deductible is the amount you must pay out-of-pocket before the plan will begin to pay benefits. The deductible applies to all covered services except preventive services/prescriptions.

When one or more family members are covered, the family deductible must be met before services are covered for any member. When you elect the Anthem PPO HDHP, you are also eligible to elect a Health Savings Account , a special tax-advantaged bank account to help cover your out-of-pocket healthcare costs. Your main doctor is called a primary care provider, or PCP.

Your PCP is listed on your ID card and in your online account. Call to make an appointment with your PCP as soon as you can. Getting a checkup now will help your PCP learn about your medical history before any health issues occur.

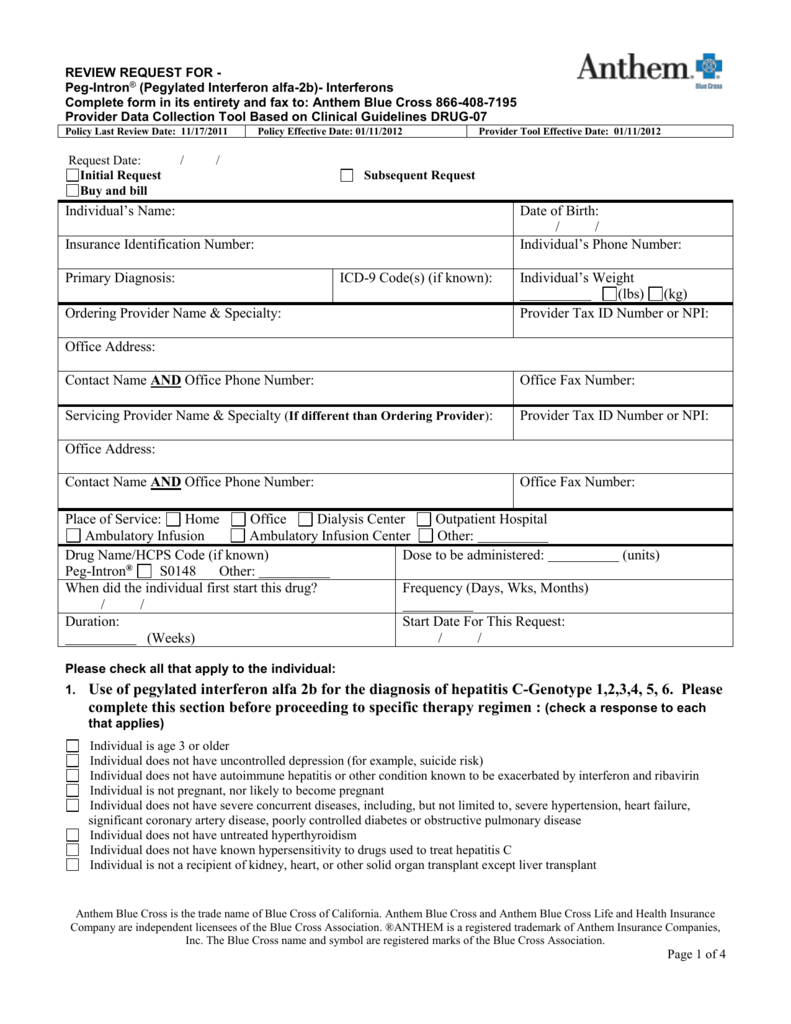

PPO -- stands for Preferred Provider Organization -- is a healthcare plan that allows people to see doctors or get services that are not part of a network. Those out-of-network services are at a higher rate, though. Plans are structured so that members will pay less money out-of-pocket when they use in-network providers. Beginning in 2013, Anthem Blue Cross became the behavioral health provider for Anthem HMO and PPO plans. If you are enrolled in one of these Anthem plans, you do not need a referral from your primary care physician in order to receive mental health services.

Visit Anthem's website at /ca for a list of behavioral health providers. If you have health insurance through work, your insurance card probably has a group plan number. The insurance company uses this number to identify your employer's health insurance policy.

You have choices for where you get non-emergency care. It's best to check your health care options before using the emergency room . Plus, when you visit in-network providers, you may pay less for care. As a mission-driven, not-for-profit company, we've been part of the community for over 75 years as the trusted insurer for individuals, families and employees in Tennessee.

So, you can expect excellent coverage, benefits and support for all your health care needs. To find out if a provider is "in network" contact your insurance company. The back or bottom of your health insurance card usually has contact information for the insurance company, such as a phone number, address, and website.

This information is important when you need to check your benefits or get other information. For example, you might need to call to check your benefits for a certain treatment, send a letter to your insurance company, or find information on the website. All health insurance cards should have a policy number. When you get a health insurance policy, that policy has a number. On your card, it is often marked "Policy ID" or "Policy #." The insurance company uses this number to keep track of your medical bills.

Yes, but you will pay the full negotiated rate for ambulance and ER services until you meet your deductible, then you will pay co-insurance. For an ER visit, you also pay an extra $125 fee, which is waived if you are admitted as an inpatient. Non-emergency care should be treated at the physician office or urgent care facility to avoid the higher out-of-pocket costs.

As a Blue Cross Blue Shield member, you and your covered dependents can receive treatment while traveling, including outside the United States. However, many healthcare benefit plans have requirements for notifying your doctor and/or Blue Cross Blue Shield for emergency and non-emergency treatment. Contact BCBS for your specific coverage guidelines while away from home. That's why as a part of your health care benefits you have access to myStrength, a free online and mobile program that supports emotional health and well-being. 24/7 online access to account transactions and other useful resources, help to ensure that your account information is available to you any time of the day or night. If you get your insurance through your employer or buy it on your own, we now support telehealth visits for these plans.

You can now have virtual visits with providers in our networks who offer this service to help you manage your health without leaving your home. Your ID card says, "I am a Blue Cross NC member." You must show it every time you visit an emergency room, urgent care center or health care provider. It's your identification that says, "I am a Blue Cross NC member." The back of your card has several important phone numbers to use when you need help. You'll need to show it every time you visit an emergency room, urgent care center or health care provider. Keep it in a safe, easily accessible place like your wallet.

Your card contains key information about your health insurance coverage that is required when you need care or pick up a prescription at the pharmacy. Keeping your card in a secure location will also help protect you from medical identity theft. A medical ID card from Blue Cross Blue Shield, a prescription drug ID card from Magellan Rx and a dental ID card from Cigna. (You will receive two of each if you have spouse, child or family coverage.) VSP does not provide ID cards - just tell your provider you have VSP. Discover a range of resources about our health care plans including sales, marketing, training and enrollment tools to help you support your clients.

If you forget or aren't sure what type of health insurance plan you have , you can find out on your BCBS ID card. If you have an HMO, your card may also list the physician or group you've selected for primary care. Determining whether a provider is in-network is an important part of choosing a primary care physician. Vision and vision wear coverage is provided through Anthem Blue View Vision.

This coverage is included with your medical plan enrollment, but vision services have their own schedule of benefits and network separate from medical benefits. Coinsurance is the percent of a covered healthcare service you pay after you have paid your deductible. For example, if your coinsurance is 20%, you pay 20% of the cost and the plan will pay the other 80%.

We're expanding the types of care available via telehealth to better meet the needs of our members. Any medically necessary service covered under a member's health plan can now be performed via telehealth when appropriate, and offered by your doctor. We're making mental health care options more available to more members in more ways than ever before with remote therapy visits, self-guided programs, and wellness offerings. Take the first step and visit our Mental Health Resource Center.

If you're looking for medical, dental and vision plans for you and your employees, we have options to keep you covered from head to toe. Every health insurance card should have the patient's name on it. If you have insurance through someone else, such as a parent, you might see that person's name on the card instead. The card might also include other information, such as your home address, but this depends on the insurance company. Vision and dental plans are a low-cost way of keeping your total health top of mind. We have plans available for all plan types - including individual and family and Medicare plans.

Vision and dental plans can be added to a health plan as you're shopping - or you can buy them on their own if you just need vision or dental care. Your BCBS ID card has your member number, and in some cases, your employer group number. Your member number, also known as your identification number, is listed directly below your name. You'll need this information when receiving medical services at the doctor or pharmacy, or when calling customer service for assistance. If your group number is available, you'll find it directly below your member number.

Indiana University is an equal employment and affirmative action employer and a provider of ADA services. All qualified applicants will receive consideration for employment based on individual qualifications. Department of Education Office for Civil Rights or the university Title IX Coordinator. See Indiana University's Notice of Non-Discrimination here which includes contact information. The out-of-pocket maximum is the most you'll have to pay for covered services in a plan year.

After you spend this amount on deductibles, copays, and coinsurance, the plan begins to pay 100% of the allowed amount for covered services. This plan uses the Anthem Blue Access PPO network in Indiana, the Anthem National PPO network in other states, and the Anthem Blue Cross Blue Shield Global Core network overseas. You can visit any provider or facility, but you receive a higher level of benefits when you use these in-network providers. You have the right to make a complaint or file an appeal about your health plan, any care you receive or any benefit determination your health plan makes.

To file a complaint, please call the Member Services number on the back of your member ID card. Register with Anthemto see your medical coverage, compare costs, find doctors, and for one-click access to LiveHealth Online. Choose and change your communication preferences at any time.

If you are not sure whether your health insurance pays for prescriptions or how much it pays, call the number on your insurance card to find out. Your member ID card – like the example shown here – identifies you as a CareFirst member and shows important information about you and your covered benefits. Each family member on your plan should have a card with their name on it. Make sure to always present your ID card when receiving services. If you don't have your physical card, you can view it on your smartphone through My Account. Blue Cross and Blue Shield of North Carolina does not discriminate on the basis of race, color, national origin, sex, age or disability in its health programs and activities.

Learn more about our non-discrimination policy and no-cost services available to you. Your member ID number identifies you as a covered member of Blue Cross and Blue Shield of New Mexico. It's very important because it is how you access your benefits when you need care, much like a credit card lets you use your account to make purchases. Your member ID number connects you to your information in our systems, and is what providers use to make sure you are covered for a treatment or medicine when you seek care. Our phones, keys, driver's licenses and credit cards are kept at our fingertips at all times. Those items are unique to each of us, and provide access to the things we need.

When it comes to healthcare services, that item is your Blue Cross Blue Shield ID card. Blue Cross Blue Shield EPO will not cover any benefits to out-of-network providers. You will be responsible for the entire cost of the claims.

The CVS Caremark pharmacy network includes most retail chain pharmacies, such as CVS, Walmart, Target, and most supermarket and club pharmacy chains. To locate network pharmacies or check prescription coverage and costs log in to Caremark.com or the Caremark app. Learn about a variety of insurance options we offer, including Medicare Advantage, Medicare supplement and Medicare prescription drug plans.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.